Nordnetin ETF-kuukausisäästösummaa ei tarvitse välttämättä muutella omien tulojen vaihdellessa. Kun asetettu säästösumma on suurempi kuin saldo, niin Nordnet-tililtä lähtee aina suurin mahdollinen summa säästöön. Eli tulojen vaihdellessa ainoa ylimääräinen työ on Nordnet-tilille siirrettävän rahamäärän muuttaminen.Olen hieman puntaroinut ETF-säästämisen aloittamista Nordnetin tai Degiron kautta. Tässä hieman plussia ja miinuksia mitä olen kerännyt:

Degiro:

+ ETF-osakkeiden kuluton ostaminen joustavampaa

+ ETF-osakkeiden myynti ilmaista

- Ei ilmoita tietoja verottajalle automaattisesti

- Degiro on aika uusi startup-tyylinen firma, jonka luotettavuudesta on vaikea sanoa. Pitkäaikainen sijoitus Degiron kautta hieman arveluttaa

Nordnet:

+ Tuntuu luotettavammalta kuin Degiro

+ Ilmoittaa tiedot verottajalle automaattisesti

- ETF kk-säästäminen ei ole kovin joustavaa, ostot vain kerran kuukaudessa. Jos tulot vaihtelevat paljon, niin kk-säästöohjelmaa pitää muutella usein.

- Myynneistä varsin korkeat kulut

Onko mitään ajatuksia kumpaa firmaa kannattaa käyttää ETF-sijoittamiseen?

-

PikanavigaatioAjankohtaista io-tech.fi uutiset Uutisia lyhyesti Muu uutiskeskustelu io-tech.fi artikkelit io-techin Youtube-videot Palaute, tiedotukset ja arvonnat

Tietotekniikka Prosessorit, ylikellotus, emolevyt ja muistit Näytönohjaimet Tallennus Kotelot ja virtalähteet Jäähdytys Konepaketit Kannettavat tietokoneet Buildit, setupit, kotelomodifikaatiot & DIY Oheislaitteet ja muut PC-komponentit

Tekniikkakeskustelut Ongelmat Yleinen rautakeskustelu Älypuhelimet, tabletit, älykellot ja muu mobiili Viihde-elektroniikka, audio ja kamerat Elektroniikka, rakentelu ja muut DIY-projektit Internet, tietoliikenne ja tietoturva Käyttäjien omat tuotetestit

Softakeskustelut Pelit, PC-pelaaminen ja pelikonsolit Ohjelmointi, pelikehitys ja muu sovelluskehitys Yleinen ohjelmistokeskustelu Testiohjelmat ja -tulokset

Muut keskustelut Autot ja liikenne Urheilu TV- & nettisarjat, elokuvat ja musiikki Ruoka & juoma Koti ja asuminen Yleistä keskustelua Politiikka ja yhteiskunta Hyvät tarjoukset Tekniikkatarjoukset Pelitarjoukset Ruoka- ja taloustarviketarjoukset Muut tarjoukset

Kauppa-alue

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Huomio: This feature may not be available in some browsers.

Lisää vaihtoehtoja

Tyylin valinta

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Säästäminen ja sijoittaminen (osakkeet, rahastot, ETF:t...)

- Keskustelun aloittaja Purple

- Aloitettu

Matti Nykänen varoitti suomalaisia haalimasta omaisuutta, ja suomalaiset uskoivat: osakkeisiin ja rahastoihin sijoitettiin keskimäärin 42 euroa henkeä kohti, rahapeleihin 570 euroa

Suomalaiset laittavat moninkertaisen summan vuosittain Veikkauksen peleihin kuin sijoittavat.

Artikkelin mukaan myös näyttäisi että huomattava määrä rahastoja lunastettiin juuri pahimmassa kuopassa, kun juuri silloin pitäisi ostaa eikä myydä. Tietysti tämä on nyt jälkikäteen helppo sanoa, mutta ajoittaminen on vaan erittäin hankalaa ja useimpien kannattaisi vaan kuukausisäästää kurssiheilasteluista huolimatta, jotta ei jäisi näistä nousu pyrähdyksistä paitsi.

Tämä oli kyllä tosi hyvä juttu Hesarilta. Näitä saisi tulla vähintään kerran kuukaudessa, jotta saataisiin tällekin kansalle taottua järkeen, että vaurastumisessa ei ole mitään pahaa ja ainut vaihtoehto Suomessa siihen ei ole asunnon ostaminen.

Artikkelissa myös hyvin avattiin tilastoilla sitä miten kansa myy kun tulee romahdus ja ostaa kun tulee nousut. Hyvin inhimillistä laumakäyttäytymistä, mutta valitettavasti tekee tuotoille hirveää. Tähän voisi varmaan etsiä ja googlata ne n+1 juttua joissa kerrotaan, miten Yhdysvalloissakin keskiverto sijoittaja jää aina hurjasti jälkeen ihan vain S&P500 indeksin tuotosta...

Ainut asia jota vähän ehkä kyseenalaistan tuossa jutussa on tuo sijoittamisen väheneminen. Nämä tiedot on varmasti otettu Suomen Sijoitustutkimuksen Rahastoraportista? Se sisältää toki vain Suomeen rekisteröidyt rahastot. Esim. itselläni ei ole yhtään tälläistä rahastoa vaan kaikki rahastot ovat Ruotsissa ja ETF:t Irlannissa, joten en noissa tilastoissa millään tavalla näy. Olisiko huomattava osa suomalaisista jo osannut siirtää sijoituksiaan kivijalkapankin tarjonnasta muuhun? Todennäköisesti toiveajattelua ja nostot nimenomaan kertovat volatiliteetin pelosta.

Jos kenellä alkupottia enempi ja haluaa irti osakepuolen normaalista volatiliteetistä, niin kannattaa tsekata myös EQ:n Hoivakiinteistörahasto.

Siinä ei nimittäin kurssiheilahtelut näy vasta kun hoivattavat loppuu tai tulee kansantaloudessa oikeesti extreme-tilanne.

Rahaston tuotot kun ei johdu mistään pörssipeleistä (vrt. esim. osakkeet), vaan kyse on hoiva-alan kiinteistöjen vuokratuotoista korkoa-korolle efektillä.

ps. Rahaston sisäänostopalkkiot on neuvoteltavissa ainakin tietyissä tapauksessa ja huom. ei taaskaan niitä kaikkia munia sitten siihen yhteen koriin

(periaatteessa OT, mutta ihan vaan tiedoksi)

Merkintäpalkkio 2,0 %

Lunastuspalkkio

omistus < 1v. 2,0%

omistus 1-3v. 1,0%

omistus 3-5v. 0,5%

omistus > 5v. 0,0%

omistus 1-3v. 1,0%

omistus 3-5v. 0,5%

omistus > 5v. 0,0%

Hallinointipalkkio p.a. (sis. säilytyspalkkion) Sarja T 1,95 %

+ 20 % siitä osasta kalenterivuoden kokonaistuottoa, joka ylittää 7,0%:n vuosittaisen vertailutuoton.

En kyllä noilla kuluilla lähtisi sijoittamaan. Vai katsonko nyt eri rahaston kuluja? eQ - eQ Hoivakiinteistöt

- Liittynyt

- 01.03.2019

- Viestejä

- 321

En kyllä noilla kuluilla lähtisi sijoittamaan. Vai katsonko nyt eri rahaston kuluja? eQ - eQ Hoivakiinteistöt

Oikeita katsot, mutta suhteuta palkkiot aina Riskiin.

Tuolle tasaisesti vuosi vuoden jälkeen isolle yli 8% (p.a.) vuotuiselle tuottokäppyrälle (kulut huomioitu), mikä vaan siis nousee tasaisesti eikä romahtele kuten esim. osakeindeksit, niin on selityksensä ja näin sille voi maksaa vähän korkeampia kuluja.

Tuotot muodostuu siis suurilta osin oikeista suorista vuokratuloista ja siksi tuottokippura on kuin sijoituskoulun oppikirjasta. Dippejä tai rommeja ei ollenkaan. Riski oikeastaan siinä, että huonompana vuotena voi tuotto-% laskea, jota ei nyt vielä ole nähty, mutta nollaan/negatiiviseksi tuskin menee (tai on äärimmäisen epätodennäköistä). Siksi voivat vähän pyytääkin enemmän.

Pitoaika tietysti, kuten ideksisäästämisessäkin, niin enemmän kuin 5v, joten lunastuskuluja ei ole. Neuvotteluvaiheessa sitten vaan ostopalkkiot pienemmiksi tai jopa nollaan, jos omalla kohdalla mahdollista.

Eli ei näitä kuluja silleen ihan suoraan voi verrata, kun miten se menee esim. osakeindekseissä tai esim. muissa pörssinoteeratuissa kiinteistölapuissa varsinkin, kun tuotto on noin hyvää ja tasaista.

Tällä perustelulla ja strategialla on itsellä exposurea kiinteistövuokrissa eikä esim. että olisi suoria omia kiinteistösijoituksia varsinkin, kun omien kiinteistöjen overhead puuttuu kokonaan. Exit tulee vasta, kun kippurat/fundat alkaa pahemmin sakkaamaan, tai tietysti jos varoille muuta tarvetta.

Eli kuten sanoin, niin kannattaa tsekata.

Viimeksi muokattu:

Oikeita katsot, mutta suhteuta palkkiot aina Riskiin.

Tuolle tasaisesti vuosi vuoden jälkeen isolle yli 8% (p.a.) vuotuiselle tuottokäppyrälle, mikä vaan siis nousee tasaisesti eikä romahtele kuten esim. osakeindeksit, niin on selityksensä ja näin sille voi maksaa vähän korkeampia kuluja.

Tuotot muodostuu siis suurilta osin oikeista suorista vuokratuloista ja siksi tuottokippura on kuin sijoituskoulun oppikirjasta. Dippejä tai rommeja ei ollenkaan. Riski oikeastaan siinä, että huonompana vuotena voi tuotto-% laskea, jota ei nyt vielä ole nähty, mutta nollaan/negatiiviseksi tuskin menee (tai on äärimmäisen epätodennäköistä). Siksi voivat vähän pyytääkin enemmän.

Pitoaika tietysti, kuten ideksisäästämisessäkin, niin enemmän kuin 5v, joten lunastuskuluja ei ole. Neuvotteluvaiheessa sitten vaan ostopalkkiot pienemmiksi tai jopa nollaan.

Eli ei näitä kuluja silleen ihan suoraan voi verrata, kun miten se menee esim. osakeindekseissä tai esim. muissa pörssinoteeratuissa kiinteistölapuissa varsinkin, kun tuotto on noin hyvää ja tasaista.

Tällä perustelulla ja strategialla on itsellä exposurea kiinteistövuokrissa eikä esim. että olisi suoria omia kiinteistösijoituksia varsinkin, kun omien kiinteistöjen overhead puuttuu kokonaan. Exit tulee vasta, kun kippurat/fundat alkaa pahemmin sakkaamaan, tai tietysti jos varoille muuta tarvetta.

Eli kuten sanoin, niin kannattaa tsekata.

Tarkemmin tutkimatta kuinka paljon tuossa menneessä käppyrässä on sotekiimassa haalittua massaa joka jollain aikavälillä tyhjenee nyt kun Sote on pahasti vastatuulessa? Toki hoivakiinteistöbisnes on varmaan suhteellisen vakaa mutta en nyt lupailisi mitään tasaista 8% vuodessa nousua kovin pitkällä tähtäimellä.

- Liittynyt

- 01.03.2019

- Viestejä

- 321

Tarkemmin tutkimatta kuinka paljon tuossa menneessä käppyrässä on sotekiimassa haalittua massaa joka jollain aikavälillä tyhjenee nyt kun Sote on pahasti vastatuulessa? Toki hoivakiinteistöbisnes on varmaan suhteellisen vakaa mutta en nyt lupailisi mitään tasaista 8% vuodessa nousua kovin pitkällä tähtäimellä.

Tuotot olleet tosiaan erinomaisia viimevuodet. Jos tuottokippura laskee 5% alle, niin kannattaa alkaa katselemaan sitten vaikka niitä omia kiinteistöhankintoja. Mutta kyllä tässä tosiaan on seuraavina vuosikymmeninä hyvänä päkuppina jatkuvasti nouseva eläkeläisten määrä.

Seuraan kyllä itse muutaman kerran vuodessa, että missä mennään ja kun kippura alkaa tasaantua, niin sitten vähän analyysiä kehiin että onko aihetta huoleen. Omalla kohdalla ei saa mennä alle 4%, tai sitten viimeistään irtaudun ja katseet muualle siltä osin.

Omassa strategiassa tämän sijoituksen vaatimus on pienemmät, mutta myös vakaammat tuotot vrt. tietyt korkosijoitukset.

Eli pidän tätä hyvänä ja toimivampana vaihtoehtona perinteisille korkolapuille.

Viimeksi muokattu:

- Liittynyt

- 17.10.2016

- Viestejä

- 397

2% on ihan perus hallinnointikulu kiinteistörahastolle, toki halvempiakin löytyy ja osassa hallinointikulu on suhteessa omaan pääomaan. Eli kun otetaan toinen mokoma velkavipua, hallinointikulu puolittuu ja sitten viedään x% ylittävästä tuotosta y%:a tuottosidonnaista kulua.

Hoivarahastollehan voi käyttää verrokkina Hoivatilojen vuosikatsausta, ellen ihan väärin laskenut niin tasan 2% sielläkin oli henkilöstö-, kiinteistöjen hoito- ja rahoituskulut. En tiedä miten nuo verot pitäisi tulkita, ne olivat kuitenkin 3.8% NAV:sta.

Hoivarahastollehan voi käyttää verrokkina Hoivatilojen vuosikatsausta, ellen ihan väärin laskenut niin tasan 2% sielläkin oli henkilöstö-, kiinteistöjen hoito- ja rahoituskulut. En tiedä miten nuo verot pitäisi tulkita, ne olivat kuitenkin 3.8% NAV:sta.

- Liittynyt

- 01.03.2019

- Viestejä

- 321

(Kurssit Yahoo & NasdaqOmxNordic)

Niin, siis postasin tuo kippuran ihan vertailuun, että kyllä se Suomiosake vähän terävämmin talouteen reagoi (niin ylös kuin alaspäin), kuin mitä jenkkiosake. Toisaalta jenkkiosaketta voi sitten ajaa vähän suuremmalla painolla, että saa Riskin samaksi, niin silloinhan se on se ja sama, koska sitä varsinaista divergenceä ei hirveän paljon näyttäisi esiintyvän.

"Islanti"-painauman jälkeenhän nuo kippurat on kyllä olleet erittäin identtiset myös liikkeen suuruuden osalta. Tosin kohinaa OMX:ssa edelleen enemmän. Tähän tietysti syynä indeksin rakenne: OMX vain 25 osaketta, kuin S&P:ssä on 500. Siksi helposti herkempää meininkiä.

Että voisiko tähän yhteenvetona sanoa, että kannattaa ajaa OMX:a, kun pienemmällä painolla pääsee samoihin tuottoihin ja olisko kuluissa sitten mitä eroa ?!

Viimeksi muokattu:

- Liittynyt

- 17.10.2016

- Viestejä

- 13 907

Kiinteistöjen tarpeen määrä ei nähdäkseni liity oikeastaan mitenkään siihen, että tuleeko Sote ja missä muodossa vaiko ei.Tarkemmin tutkimatta kuinka paljon tuossa menneessä käppyrässä on sotekiimassa haalittua massaa joka jollain aikavälillä tyhjenee nyt kun Sote on pahasti vastatuulessa? Toki hoivakiinteistöbisnes on varmaan suhteellisen vakaa mutta en nyt lupailisi mitään tasaista 8% vuodessa nousua kovin pitkällä tähtäimellä.

Itseasiassa Sote lähinnä vähentää nähdäkseni kiinteistöjen tarvetta, koska se mahdollistaa sote-alueen / maakunnan tasolla keskittämisen. Kunnalliset toimivat sen sijaan hajauttavat pieniä tiloja useampaan paikkaan.

Kokeilin Lynxin rapsalla, jota on näköjään kostumoitu niin että sarakkeet menee eri tavalla. Tätä parseri ei sit tietystikkään ymmärrä. Pitää katsoa, jos jaksaa alkaa säätämään. Skripti itsessään näyttää ihan asialliselta.Mainos: Omaverossa on on näköjään nyt mahdollista ilmoittaa könttänä luovutusvoitot ihan virallisesti ilman mitään päivämääriä tai muutakaan kommervenkkiä. Liitteeksi kaupankäyntiloki tai joku muu vastaava. IB_trade_parser.py siis oikeastaan vahingossa täyttää verottajan kirjaimen 99,9%,

...

PS. onko kukaan testannut tuota tekemääni trade-parser skriptiä?

Kannattaa ainakin tarkistaa se Degiron ETF -lista että sieltä löytyy osingot uudelleensijoittavia ja kuluiltaan muuten pieniä ETF:iä. Mielestäni pitkäjänteiseen sijoittamiseen tuo Nordnetin kuukausisäästö toimii helposti ja jos tulot vaihtelevat niin veikkaan että se kuukausisäästön muuttaminen välillä on kuitenkin helpompaa kun veroilmoituksen tekeminen manuaalisesti.

Olen vertaillut ETF-listoja ja en tosiaan löytänyt ihan mieleistä ETF:ää Degirolta. Matalimmat kulut näyttäisivät olevan iSharesin ja Vanguardin S&P500 rahastoissa (0,07%), mutta ne ovat molemmat osinkoja jakavia. Nordnetistä sen sijaan löytyy iSharesin osingot uudelleensijoittava S&P500 rahasto 0,07% kuluilla.

Onko? Jos nyt kuitenki ajatellaan, että sieltä ei mitään satasen myyntejä olla tekemässä kerta pitkäaikasta säästöä ollaan harrastamassa, nii onko nämä kulut nyt nii ihan hirviän isot. Yli 1500€ myynneissä mennään jo alle 1%. toki jos tarpeeksi säästää nii ollaan sit kuitenki tuolla private banking puolella, että myynnit vois olla 700€ kipale ja silti 1%. Toki ilmaiseen verrattuna, mutta muihin maksullisiin.

Olet oikeassa, kulut ovat loppujen lopuksi varsin pienet. Varsinkin kun tarkoituksena on säästää pitkäaikaisesti, niin myynneistä ei pitäisi syntyä kuluja juurikaan.

Nordnetin ETF-kuukausisäästösummaa ei tarvitse välttämättä muutella omien tulojen vaihdellessa. Kun asetettu säästösumma on suurempi kuin saldo, niin Nordnet-tililtä lähtee aina suurin mahdollinen summa säästöön. Eli tulojen vaihdellessa ainoa ylimääräinen työ on Nordnet-tilille siirrettävän rahamäärän muuttaminen.

Kiitos tästä vinkistä. Voisin oikeastaan laittaa verkkopankista kuukausittain toistuvan maksun, ja tehdä manuaalisesti ylimääräisen maksun silloin kun tilille on kertynyt ylimääräistä.

Kiitos vielä kaikille vastaajille! Vastauksenne saivat minut kallistumaan Nordnetin puoleen.

Kuluissa on merkittävä ero OMXH25:en eduksi (ehkä noin 0,3 % vuodessa osinkoveroineen). OMXH on toisaalta huomattavasti keskittyneempi: "savupiipputeollisuutta" suurin osa, vain yksi varsinainen IT-yhtiö, vain yksi lääkefirma jne.Niin, siis postasin tuo kippuran ihan vertailuun, että kyllä se Suomiosake vähän terävämmin talouteen reagoi (niin ylös kuin alaspäin), kuin mitä jenkkiosake. Toisaalta jenkkiosaketta voi sitten ajaa vähän suuremmalla painolla, että saa Riskin samaksi, niin silloinhan se on se ja sama, koska sitä varsinaista divergenceä ei hirveän paljon näyttäisi esiintyvän.

"Islanti"-painauman jälkeenhän nuo kippurat on kyllä olleet erittäin identtiset myös liikkeen suuruuden osalta. Tosin kohinaa OMX:ssa edelleen enemmän. Tähän tietysti syynä indeksin rakenne: OMX vain 25 osaketta, kuin S&P:ssä on 500. Siksi helposti herkempää meininkiä.

Että voisiko tähän yhteenvetona sanoa, että kannattaa ajaa OMX:a, kun pienemmällä painolla pääsee samoihin tuottoihin ja olisko kuluissa sitten mitä eroa ?!

EDIT: No eipä S&P 500 näköjään olekaan nykyään erityisen hyvin hajautettu, kun lähes neljännes on IT-firmoja. Tai oikeastaan "teknologiayhtiöitä", mutta IT-firmoja sillä kai tarkoitetaan.

Viimeksi muokattu:

Olen vertaillut ETF-listoja ja en tosiaan löytänyt ihan mieleistä ETF:ää Degirolta. Matalimmat kulut näyttäisivät olevan iSharesin ja Vanguardin S&P500 rahastoissa (0,07%), mutta ne ovat molemmat osinkoja jakavia. Nordnetistä sen sijaan löytyy iSharesin osingot uudelleensijoittava S&P500 rahasto 0,07% kuluilla.

Olet oikeassa, kulut ovat loppujen lopuksi varsin pienet. Varsinkin kun tarkoituksena on säästää pitkäaikaisesti, niin myynneistä ei pitäisi syntyä kuluja juurikaan.

Kiitos tästä vinkistä. Voisin oikeastaan laittaa verkkopankista kuukausittain toistuvan maksun, ja tehdä manuaalisesti ylimääräisen maksun silloin kun tilille on kertynyt ylimääräistä.

Kiitos vielä kaikille vastaajille! Vastauksenne saivat minut kallistumaan Nordnetin puoleen.

Itse kanssa viime vuoden kesällä mietin jos vaihtaisi Nordnetin kk-säästö ETF:t (EUNL ja IS3N) Degiron lähes vastaaviin (en nyt muista niiden tickereitä), mutta noissa oli muistaakseni joitain eroja, Nordnetin hyväksi (eli EUNL "vastaava" ETF Amsterdamin pörssissä), niin en nähnyt vaivaa siinä. Nordnet tässä tapauksessa loistava. Degiro taas on tosi edullinen jos haluat sijoittaa suoraan esim jenkkipörssiin.

Olikohan kyseessä kuitenkin samat ETF:t?Itse kanssa viime vuoden kesällä mietin jos vaihtaisi Nordnetin kk-säästö ETF:t (EUNL ja IS3N) Degiron lähes vastaaviin (en nyt muista niiden tickereitä), mutta noissa oli muistaakseni joitain eroja, Nordnetin hyväksi (eli EUNL "vastaava" ETF Amsterdamin pörssissä), niin en nähnyt vaivaa siinä. Nordnet tässä tapauksessa loistava. Degiro taas on tosi edullinen jos haluat sijoittaa suoraan esim jenkkipörssiin.

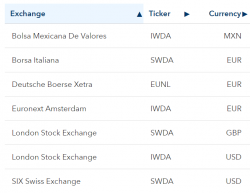

iShares Core MSCI World ETF:

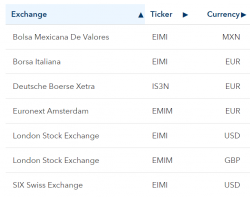

iShares Core MSCI EM IMI ETF:

Joo eli EUNL "vastaava" etf Amsterdamin pörssissä on IWDA ja and IS3N vastaava on IEMA.

Obi-Lan

¯\_(ツ)_/¯

- Liittynyt

- 17.10.2016

- Viestejä

- 2 396

Mitä arvon väki on muuten mieltä Atarin rinnakkaislistautumisannista? Atari löytyy Pariisin pörssin listoilta ja nyt on siis tulossa Tukholmaan. Atarifirmana– tai oikea termi taitaa olla brändinä – herättää itselläni suuria nostalgisia tunteita. Mutta sijoitushommissa tunne taitaa olla huono ajomies.

Atari firmana ei ainakaan pikaisen silmäilyn perusteella herätä suurta wow-efektiä itselläni. Ok, Infogrames löytyy taustalta. Ihan järkeviäkin ja jopa itselle tuttuja julkaisuja heillä. Tosin ne vanhat julkaisut ja 70-luvun kaman jälleenlisensoinnit tuskin ovat riittävän kannattavaa? Onko joku muu paremmin kartalla tästä nykyisestä Atarin nimellä ratsastavasta putiikista?

Ton perusteella skippaisin, ilmeisesti Indiegogosta tms joukkorahoituksista vedätetty mitä saatu ja nyt kokeillaan pörssin kautta?

- Liittynyt

- 16.08.2018

- Viestejä

- 1 534

Tästä lottoaville pohjaonkiosake eli Maxar. Kieppui vielä pari vuotta sitten satasen kieppeillä nyt rapiat 6 taalaa (CAD). Hukkasivat mm. satelliitin ja muuta pientä vastoinkäymistä.

https://finance.yahoo.com/quote/MAXR.TO?p=MAXR.TO

https://finance.yahoo.com/quote/MAXR.TO?p=MAXR.TO

Tästä lottoaville pohjaonkiosake eli Maxar. Kieppui vielä pari vuotta sitten satasen kieppeillä nyt rapiat 6 taalaa (CAD). Hukkasivat mm. satelliitin ja muuta pientä vastoinkäymistä.

https://finance.yahoo.com/quote/MAXR.TO?p=MAXR.TO

Nonni, All In! Näkyy olevan jo alle 5 taalaa per osake. Voishan noita lottokuponkeja muutaman lunastaa.

- Liittynyt

- 01.03.2019

- Viestejä

- 321

Nonni, All In! Näkyy olevan jo alle 5 taalaa per osake. Voishan noita lottokuponkeja muutaman lunastaa.

Parhaat lotot on tällä hetkellä kryptoissa.

- Liittynyt

- 16.08.2018

- Viestejä

- 1 534

Kyllä se on edelleen se sama rapiat 6 CAD (6.26 just nyt). Eli se on myös jenkkipörssissä, jolloin se noteerataan siellä 4.66USD.Nonni, All In! Näkyy olevan jo alle 5 taalaa per osake. Voishan noita lottokuponkeja muutaman lunastaa.

Viimeksi muokattu:

- Liittynyt

- 16.08.2018

- Viestejä

- 1 534

Itselle kuitenkin epäselvää niiden tulevaisuus. Bitcoinko siellä vie potin, jos vie? Siitä voi olla varma, että suurin osa niistä wannabee-bitcoinesta menee kanttu vei. Yksi niistä taisi jo kaatua siihen, että ainoa joka muisti salasanan sattui kuolemaan ja leski ei löytänyt papereista/läppäriltä mitään.Parhaat lotot on tällä hetkellä kryptoissa.

Parhaat lotot on tällä hetkellä kryptoissa.

Volatiliteettia ainakin riittää, jos haluaa päivätreidata. Hitusen liian riskialtista puuhaa minulle toi valaiden pyörittämä kryptomarkkina, vaikka ostin pari lappua Baswarea.

Kyllä se on edelleen se sama rapiat 6 CAD (6.26 just nyt). Eli se on myös jenkkipörssissä, jolloin se noteerataan siellä 4.66USD.

Kappas meni valuutat sekaisin. Maxarista: "

Between now and then, of course, Maxar needs to at least continue generating enough cash to service its sizable $3.2 billion debt load until 2020 rolls around and the company can begin paying down that debt. With interest costs now approaching $200 million per year, and Maxar earning less than that in operating profit, there's a very good chance Maxar would need to sell more stock or take on new debt in order to pay off old debt.

Simply put, Maxar is cutting things really close. If Maxar can make the numbers work, however, and survive through 2019, this company should have a bright future in 2020 and beyond.".

Noh, mutta sehän ei pelaa joka pelkää.

- Liittynyt

- 16.08.2018

- Viestejä

- 1 534

Joo, mainitaan tässä, että ostin itse siis 50 kpl. Eli saman mitä keskiarvosuomaisella menee lottoon viidessä kuukaudessa.Kappas meni valuutat sekaisin. Maxarista: "

Between now and then, of course, Maxar needs to at least continue generating enough cash to service its sizable $3.2 billion debt load until 2020 rolls around and the company can begin paying down that debt. With interest costs now approaching $200 million per year, and Maxar earning less than that in operating profit, there's a very good chance Maxar would need to sell more stock or take on new debt in order to pay off old debt.

Simply put, Maxar is cutting things really close. If Maxar can make the numbers work, however, and survive through 2019, this company should have a bright future in 2020 and beyond.".

Noh, mutta sehän ei pelaa joka pelkää.

Näitä vastaavia riittää, eli yhteen osakkeeseen vain vähän rahaa, portfoliona jää todennäköisesti voitolle pitkässä juoksussa kunhan ei myy liian aikaisin.

- Liittynyt

- 10.07.2017

- Viestejä

- 2 595

Näin pääset miljonäärinä eläkkeelle – ”Oikeasti niin helppoa”

Noniin, tuolla aiemmin linkattu "uutinen" on bonjautunut Iltapaskaankin. Itse uutisessa ei ole mitään ihmeellistä, mutta kommenttiosio räjäyttää pankin.

Kannattaa kaikkien lukea, jotka aiemmin luulivat tietävänsä sijoittamisesta jotain.

Noniin, tuolla aiemmin linkattu "uutinen" on bonjautunut Iltapaskaankin. Itse uutisessa ei ole mitään ihmeellistä, mutta kommenttiosio räjäyttää pankin.

Kannattaa kaikkien lukea, jotka aiemmin luulivat tietävänsä sijoittamisesta jotain.

Tuonne kommentoivat eivät välttämättä edusta kovin kattavaa otosta suomalaisista. Eli ihan niin surullinen tilanne ei ole kyseessä.Näin pääset miljonäärinä eläkkeelle – ”Oikeasti niin helppoa”

Noniin, tuolla aiemmin linkattu "uutinen" on bonjautunut Iltapaskaankin. Itse uutisessa ei ole mitään ihmeellistä, mutta kommenttiosio räjäyttää pankin.

Kannattaa kaikkien lukea, jotka aiemmin luulivat tietävänsä sijoittamisesta jotain.

Tai ainakin näin toivon.

Kertoo kyllä aika paljon suomalaisten taloustaidoista tuo kommenttikenttä ja siitä, miksi on niin paljon luottotietonsa menettäneitä. Kaikki pitää käyttää (ja vähän ylikin) koska saatat kuolla huomenna...  Eihän sen säästösumman tarvitse olla niin suuri, ettei voisi mitään koskaan ostaa.

Eihän sen säästösumman tarvitse olla niin suuri, ettei voisi mitään koskaan ostaa.

"Ei mulla ole varaa" tuntuu olevan suosituin tekosyy. Kummasti sitä siideriä ja tupakkia löytyy aina kaapista. Toki tiedostan, että joillakin ei oikeasti ole varaa, mutta suuri osa on näitä edellä kuvailemiani.

Eihän sen säästösumman tarvitse olla niin suuri, ettei voisi mitään koskaan ostaa.

Eihän sen säästösumman tarvitse olla niin suuri, ettei voisi mitään koskaan ostaa."Ei mulla ole varaa" tuntuu olevan suosituin tekosyy. Kummasti sitä siideriä ja tupakkia löytyy aina kaapista. Toki tiedostan, että joillakin ei oikeasti ole varaa, mutta suuri osa on näitä edellä kuvailemiani.

Tästä tulikin mieleen teoria, jota olen aika ajoin pohtinut.Kertoo kyllä aika paljon suomalaisten taloustaidoista tuo kommenttikenttä ja siitä, miksi on niin paljon luottotietonsa menettäneitä. Kaikki pitää käyttää (ja vähän ylikin) koska saatat kuolla huomenna...Eihän sen säästösumman tarvitse olla niin suuri, ettei voisi mitään koskaan ostaa.

"Ei mulla ole varaa" tuntuu olevan suosituin tekosyy. Kummasti sitä siideriä ja tupakkia löytyy aina kaapista. Toki tiedostan, että joillakin ei oikeasti ole varaa, mutta suuri osa on näitä edellä kuvailemiani.

Monella pienituloisella vaikuttaa olevan suhteettoman korkeat elinkustannukset. Olen keskituloinen perheellinen henkilö, ja kirjanpitoni mukaan tulisin toimeen noin 1500 euron nettotuloilla, ja siitäkin jäisi hieman puskuria säästöön. Väitän, että monella pienituloisella menot ovat suuremmat kuin 1500 euroa kuussa.

Teoriani on tämä: pienituloiset usein eivät omaa kolmannen asteen koulutusta ja siten eivät ole eläneet varsinaista opiskelijaelämää. Vanhempien täyshoidosta on siirrytty melkeinpä suoraan työelämään tienaamaan. Tämän vuoksi he eivät ole kokeneet, miten tullaan toimeen äärimmäisen pienillä tuloilla eivätkä siten ole oppineet säästäväisiksi.

Mikkos

Tukijäsen

- Liittynyt

- 17.10.2016

- Viestejä

- 19 160

Toi mitä toisella on ja toisella ei on ihan turhaa haihattelua. Jokaisella on omat juttunsa tärkäysjärjestyksessä jotka menevät sen säästämisen yli. Samoin kuin perutyöttömän haukkuminen kun se sanoo että ei ole varaa. Aina löytyy joku joka sanoo:Kertoo kyllä aika paljon suomalaisten taloustaidoista tuo kommenttikenttä ja siitä, miksi on niin paljon luottotietonsa menettäneitä. Kaikki pitää käyttää (ja vähän ylikin) koska saatat kuolla huomenna...Eihän sen säästösumman tarvitse olla niin suuri, ettei voisi mitään koskaan ostaa.

"Ei mulla ole varaa" tuntuu olevan suosituin tekosyy. Kummasti sitä siideriä ja tupakkia löytyy aina kaapista. Toki tiedostan, että joillakin ei oikeasti ole varaa, mutta suuri osa on näitä edellä kuvailemiani.

-"Ei ole muka rahaa ja silti on noin iso telkkari olohuoneessa"

-"Ei ole muka rahaa ja silti omistaa kotiteatterin"

-"Ei ole muka rahaa ja silti omistaa koiran"

-"Ei ole muka rahaa ja silti juovat alkoholia"

-"Ei ole muka rahaa ja silti asuvat kaksiossa vaikka yksiökin riittäisi"

-"Ei ole muka rahaa ja asuvat vuokralla vaikka oma olis järkevämpi"

-"Ei ole muka rahaa ja silti asuvat keskustassa missä on korkeammat asumiskulut"

-"Ei ole muka rahaa silti omistavat niin uuden auton"

-"Ei ole muka rahaa ja silti omistavat auton"

-"Ei ole muka rahaa ja silti käydään viikottain ravintolassa"

-"Ei ole rahaa ja silti on lapsia, ajattelisivat ensin"

Tää on ihan loputon suo. Jokaisella ihmisellä on ne prioriteetit elämässä ja kaikki eivät voi vaan laittaa 300e säästöön ja 300e uuteen puhelimeen. Jodenkin on pakko valita kumpaan rahansa käyttävät. Ja silloin kun tulot on pienet niin sitä monesti käyttää sen rahan johonkin mistä tulee hyvä mieli ja auttaa nauttimaan elämästä tässä ja nyt. Se ei välttämättä auta että sulla on 40v päästä tilillä enemmän rahaan kun ensin 60v syöt kaurapuuroa ja elät vuokrayksiössä.

- Liittynyt

- 09.11.2016

- Viestejä

- 593

Teoriani on tämä: pienituloiset usein eivät omaa kolmannen asteen koulutusta ja siten eivät ole eläneet varsinaista opiskelijaelämää. Vanhempien täyshoidosta on siirrytty melkeinpä suoraan työelämään tienaamaan. Tämän vuoksi he eivät ole kokeneet, miten tullaan toimeen äärimmäisen pienillä tuloilla eivätkä siten ole oppineet säästäväisiksi.

Aika löyhä teoria tämä kyllä on. En itse kyllä suostu mitenkään uskomaan että vain koulutetut ihmiset olisivat oppineet säästämään. Se on kyllä totta että pienituloiset harvemmin niitä vähiä roposiaan säästöön laittavat vaan kaikki menee suoraan kiertoon, mutta esittämiäsi väitteitä on vaikea allekirjoittaa.

Lynxin runko lienee kuitenkin "vastaava", voisin ajan kuluksi yrittää naputella tuen tuollekin jos koet että sille olisi käyttöä? Tarttisin toki XML:n (IB:n rapsan ainakin pystyi kohtuudella anonymisoimaan kun vain search&replacella vaihtoi tilin "U12345678" tunnuksen jos ei haittaa kauppoja paljastaa, tietysti pelkän trades-osion kenttien (1 traden) tiedot auttaisi myös. Periaatteessa tuohon voisi koittaa naputella jonkun automaattisen tunnistamisenkin, mutta se olettavasti vaatisi jotain tietoa rapsan alusta, toinen vaihtoehto olisi tehdä konffiparsku...Kokeilin Lynxin rapsalla, jota on näköjään kostumoitu niin että sarakkeet menee eri tavalla. Tätä parseri ei sit tietystikkään ymmärrä. Pitää katsoa, jos jaksaa alkaa säätämään. Skripti itsessään näyttää ihan asialliselta.

Aika löyhä teoria tämä kyllä on. En itse kyllä suostu mitenkään uskomaan että vain koulutetut ihmiset olisivat oppineet säästämään. Se on kyllä totta että pienituloiset harvemmin niitä vähiä roposiaan säästöön laittavat vaan kaikki menee suoraan kiertoon, mutta esittämiäsi väitteitä on vaikea allekirjoittaa.

Ei varmaan ollutkaan kirjoittajan tarkoitus väittää, että asia olisi täysin mustavalkoinen. Mutta kyllähän sillä on ihan varmasti vaikutusta, jos joutuu elämään 3-7 vuotta siten, että kiinteiden kulujen jälkeen käteen jää 100 euroa. Korkeasti koulutetuista suurimmalle osalle on myös todennäköisesti joko suoraan tai epäsuoraan tullut jossain vaiheessa silmien eteen dia, jossa esitetään tätä meidän talousjärjestelmää ja sen nyansseja. Ainakin teknillisellä alalla kaikki joutuivat (ainakin muutamia vuosia sitten kun itse olin) käymään jonkun 5 opintopisteen peruskurssin.

Lisäksi se korkeakoulutuksen perusajatus, että kykenee sisäistämään ja yhdistelemään monenlaista tietoa sekä haastamaan omia ajatuksiaan, varmasti auttaa myös tajuamaan virheitä, mitä on esimerkiksi kotikasvatuksessa saanut kuunnella.

Ei tarvi alkaa säätämään. Ei tuohon tarvi vaihtaa kuin sarakkeiden järjestys, minkä pystyy kyllä itsekin tekemään. Varmaan tänäkin vuonna mennään oman kirjanpidon mukaan. Trades-rapsassa näytti olevan osa hankintahinnoista väärin.Lynxin runko lienee kuitenkin "vastaava", voisin ajan kuluksi yrittää naputella tuen tuollekin jos koet että sille olisi käyttöä?

- Liittynyt

- 17.10.2016

- Viestejä

- 6 183

Tässä kun tuota ETF kuukausisäätön päivämäärää saa odotella niin tulee pyöriteltyä millä kokoonpanolla lähtisi menemään. EUNL + IS3N on niin monta kertaa tullut täällä jo, että suurin osa porkkanoista niihin, mutta onko ihan turha laittaa kaveriksi pari merkintää Japaniin: https://next.nordnet.fi/instrument/...7513168a8abc647e2bd7e31&stopLossTabOpen=false ja pelkkään Eurooppaan: BlackRock iShares Core MSCI Europe UCITS ETF EUR (Acc) (EUNK) - osta osakkeita - Nordnet

EUNL:ssä on kuitenkin vain 10% osuus eurooppaa... Joten sen takia mieluusti pelkkään eurooppaankin.

Vaikka tuon Japani ETF:n historia ei ole niin mairitteleva itsellä on mielikuva siitä, että Japani tulee seisomaan pystyssä pitemmälläkin aika jaksolla.

Osakkeita on tullut huvikseen kelattua, mutta eihän noista osaa mitään sanoa kun ei ole perehtynyt. Ostamisen arvoiset tuntuvat olevan niin korkealla, että tyhmä nyt ostaa ja matalalla olevista tiedä nousevatko .

.

Jos tohon nyt soveltaisi jotain omaa tulevaa maailmankuvaa niin mistä löytäisi helpolla yrityksiä, jotka olisivat mukana kierrätyksessä, uusiutuvassa energiassa, akkubisneksessä ja tälläisessä ideologisessa ehkä vähän vihervassarimaisessa hömpässä? En hae mitään tuulimyllyponzeja ja lyhyen aikavälin tuottoja vaan jotain mihin laittaa ja unohtaa. Väestömäärän räjähtäessä uskoisin myös, että nuo nousee ja kaatopaikakaivetaan tyhjiksi kun sisältävät tonnia kohti huomattavan määrän arvokkaita raaka-aineita vs. normi kaivostoiminta. Ts. kun mietin sitä 20v strategiaa ja noita sikiäviä ihmismassoja tällä pallolla niin joku niistäkin salakuljettajien lisäksi tekee oikeaa rahaa niin mielellään laittaisi lottokuponkeja niihin firmoihin.

Tarkoitus olisi siis ihan huvikseen käyttää vaikka joku touhutonni johonkin lappuihin, istua niiden päällä. Tyhjiä lupauksiakin on varmaan tuollakin saralla kymmenen tusinassa.

EUNL:ssä on kuitenkin vain 10% osuus eurooppaa... Joten sen takia mieluusti pelkkään eurooppaankin.

Vaikka tuon Japani ETF:n historia ei ole niin mairitteleva itsellä on mielikuva siitä, että Japani tulee seisomaan pystyssä pitemmälläkin aika jaksolla.

Osakkeita on tullut huvikseen kelattua, mutta eihän noista osaa mitään sanoa kun ei ole perehtynyt. Ostamisen arvoiset tuntuvat olevan niin korkealla, että tyhmä nyt ostaa ja matalalla olevista tiedä nousevatko

Jos tohon nyt soveltaisi jotain omaa tulevaa maailmankuvaa niin mistä löytäisi helpolla yrityksiä, jotka olisivat mukana kierrätyksessä, uusiutuvassa energiassa, akkubisneksessä ja tälläisessä ideologisessa ehkä vähän vihervassarimaisessa hömpässä? En hae mitään tuulimyllyponzeja ja lyhyen aikavälin tuottoja vaan jotain mihin laittaa ja unohtaa. Väestömäärän räjähtäessä uskoisin myös, että nuo nousee ja kaatopaikakaivetaan tyhjiksi kun sisältävät tonnia kohti huomattavan määrän arvokkaita raaka-aineita vs. normi kaivostoiminta. Ts. kun mietin sitä 20v strategiaa ja noita sikiäviä ihmismassoja tällä pallolla niin joku niistäkin salakuljettajien lisäksi tekee oikeaa rahaa niin mielellään laittaisi lottokuponkeja niihin firmoihin.

Tarkoitus olisi siis ihan huvikseen käyttää vaikka joku touhutonni johonkin lappuihin, istua niiden päällä. Tyhjiä lupauksiakin on varmaan tuollakin saralla kymmenen tusinassa.

Viimeksi muokattu:

- Liittynyt

- 01.03.2019

- Viestejä

- 321

Itselle kuitenkin epäselvää niiden tulevaisuus...

Volatiliteettia ainakin riittää, jos haluaa päivätreidata. Hitusen liian riskialtista puuhaa...

Juu siitähän "lotossa" onkin aina kyse, että voittomahdollisuus on häviävän pieni ja kenelläkään ei hajua että mikä se lottorivi on, mutta jos se kohdalle osuu, niin sitten jytisee ja kunnolla

Onhan noita kryptoja ihan hillittömästi tarjolla ja luokkaa 99% on skeidaa. Oma veto/lotto on ollut jo jonkin aikaa EOS ja tähän mennessä näyttää ihan hyvältä tulevaisuus, niin teknisesti kuin fundienkin perusteella.

Pidän sitä ehdottomasti edistyneimpänä dapps-alustana ja siksi sitä.

Huom! Ja taaskaan ei ole kaikki munat yhdessä korissa, vaan sopivan pienellä siivulla Riskit huomioiden ja myöskään tämä ei ole mikään ostosuositus

Viimeksi muokattu:

Olen noin 10v sijoittanut suoraan osakkeisiin Nordnetin kautta. Pitkään ketjua lukeneena ajattelin viimein siirtyä myös ETF kuukausisäästäjäksi. Nuo rahastojen nimet ja kuvaukset tuottavat vielä kuitenkin hieman päänvaivaa, joten voisiko joku vielä vääntää rautalangasta mikä olisi suositeltava kombo.

Toiveena olisi:

Toiveena olisi:

- Rahasto löytyy Nordnetistä

- Mahdolliset osingot sijoitetaan automaattisesti uudestaan

- Alueellinen hajautus (Nykyiset osakkeet ovat pääsääntöisesti Helsingin pörssistä)

- Kuukaudessa sijoittaisin 300 - 500e

- Liittynyt

- 17.10.2016

- Viestejä

- 13 907

Tässä thredissa monta kertaa mainittu EUNL.Olen noin 10v sijoittanut suoraan osakkeisiin Nordnetin kautta. Pitkään ketjua lukeneena ajattelin viimein siirtyä myös ETF kuukausisäästäjäksi. Nuo rahastojen nimet ja kuvaukset tuottavat vielä kuitenkin hieman päänvaivaa, joten voisiko joku vielä vääntää rautalangasta mikä olisi suositeltava kombo.

Toiveena olisi:

- Rahasto löytyy Nordnetistä

- Mahdolliset osingot sijoitetaan automaattisesti uudestaan

- Alueellinen hajautus (Nykyiset osakkeet ovat pääsääntöisesti Helsingin pörssistä)

- Kuukaudessa sijoittaisin 300 - 500e

Jos haluat konfiguroida kaksi ETF:ää, niin EUNL + IS3N jollain tyyliin 80:20 tai 85:15 painotuksilla.

EUNL on siis n. 1670 suuryritystä "kehittyneiltä" markkinoilta (USA/Kanada, Eurooppa, Japani, Singapore, Australia jne.). IS3N taas "kehittyviltä" markkinoilta (Kiina, Taiwan, Korea, Intia, Brasilia yms.) luokkaa 2400 suurempaa yritystä.

Painotus 85:15 kuvastaa ~markkina-arvopainotusta. Kehittyvät markkinat ovat pieni osa globaalista kokonaismarkkinasta, joten mikäli et halua ylipainottaa sitä, ei sen osuutta kannata nostaa hirveästi yli 15-20%:in. Se on myös perinteisesti ollut paljon enemmän heittelehtivä kuin EUNL.

Viimeksi muokattu:

- Liittynyt

- 20.03.2017

- Viestejä

- 1 550

Kertoo kyllä aika paljon suomalaisten taloustaidoista tuo kommenttikenttä ja siitä, miksi on niin paljon luottotietonsa menettäneitä. Kaikki pitää käyttää (ja vähän ylikin) koska saatat kuolla huomenna...Eihän sen säästösumman tarvitse olla niin suuri, ettei voisi mitään koskaan ostaa.

"Ei mulla ole varaa" tuntuu olevan suosituin tekosyy. Kummasti sitä siideriä ja tupakkia löytyy aina kaapista. Toki tiedostan, että joillakin ei oikeasti ole varaa, mutta suuri osa on näitä edellä kuvailemiani.

Tämä on kyllä ihmeellistä. Itseltäni löytyy melkoisen hyvin sijoittaa osakkeisiin näin ihan opiskelijana ja vaikka töissä tulee oltua vain kesällä.

Mikkos

Tukijäsen

- Liittynyt

- 17.10.2016

- Viestejä

- 19 160

Edelleenkin, riippuu niin paljon tulosta, tulevaisuuden näkymistä, miten nuukasti haluaa elää jne.Tämä on kyllä ihmeellistä. Itseltäni löytyy melkoisen hyvin sijoittaa osakkeisiin näin ihan opiskelijana ja vaikka töissä tulee oltua vain kesällä.

Ei voi mitenkään yleispätevästi sanoa että "mulla löytyy hyvin varaa sijoittaa vaikka opiskelija ja kesän töissä". Tuostakaan ei selviä mitä opiskelee, paljonko omaisuutta ennestään, paljonko asuminen maksaa, paljonko "pappa betalar" jne.

- Liittynyt

- 20.03.2017

- Viestejä

- 1 550

Edelleenkin, riippuu niin paljon tulosta, tulevaisuuden näkymistä, miten nuukasti haluaa elää jne.

Ei voi mitenkään yleispätevästi sanoa että "mulla löytyy hyvin varaa sijoittaa vaikka opiskelija ja kesän töissä". Tuostakaan ei selviä mitä opiskelee, paljonko omaisuutta ennestään, paljonko asuminen maksaa, paljonko "pappa betalar" jne.

Yliopistossa tulee opiskeltua, aikaisempi omaisuus kaikki sijoittettu, pappa betalar 0€, mitenkään erityisen nuukasti ei tule elettyä, kun tulee käytyä ryyppäämässäkin melko usein varsinkin näin vappuna. Ainoastaan asuminen on halpaa (400€/kk), koska asun pienessä 25 neliön yksiössä. Mitä tarkastelin kuulun 2. huonoimpaan tulokymmenykseen: Tilastokeskus - 2. Tulokehitys tulokymmenyksittäin

Mikkos

Tukijäsen

- Liittynyt

- 17.10.2016

- Viestejä

- 19 160

Aattele. Jos jättäisit sijoittamiset pois voisit ehkä asia saunallisessa kaksiossa, omistaa tai hommata auton ja vois ehkä jäädä rahaa lomamatkoihinkin. Eikä tarviis kesällä käydä töissä kun jätät sijoittamiset tekemättä. Moni opiskelee ilman kesätöitä ja ihan hyvin tulee toimeen.Yliopistossa tulee opiskeltua, aikaisempi omaisuus kaikki sijoittettu, pappa betalar 0€, mitenkään erityisen nuukasti ei tule elettyä, kun tulee käytyä ryyppäämässäkin melko usein varsinkin näin vappuna. Ainoastaan asuminen on halpaa (400€/kk), koska asun pienessä 25 neliön yksiössä. Mitä tarkastelin kuulun 2. huonoimpaan tulokymmenykseen: Tilastokeskus - 2. Tulokehitys tulokymmenyksittäin

- Liittynyt

- 20.03.2017

- Viestejä

- 1 550

Aattele. Jos jättäisit sijoittamiset pois voisit ehkä asia saunallisessa kaksiossa, omistaa tai hommata auton ja vois ehkä jäädä rahaa lomamatkoihinkin. Eikä tarviis kesällä käydä töissä kun jätät sijoittamiset tekemättä. Moni opiskelee ilman kesätöitä ja ihan hyvin tulee toimeen.

Ei ole kyllä lomamatkoja tarvinnut jättää pois. Viime vuonna kävin Prahassa ja Budapestissä tänä vuonna olen jo käynyt Maltalla. Isommalle asunnolle ei ole tarvetta tai autolle, kun en ole perheellinen. Lähinnä sitä, että mielestäni pienistäkin tuloista voi säästää ilman, että tarvitsee erityisen paljon nuukailla tai muuten elää epämukavasti.

Mikkos

Tukijäsen

- Liittynyt

- 17.10.2016

- Viestejä

- 19 160

Niimpä. Ehkä joku arvostaa vähän erilaisia asioita. Joku ehkä haluaa asua väljemmin ja haluaa omistaa auton mielummin kuin sijoittaa muutama ropo osakkeisiin mistä pääsee mahdollisesti nauttimaan 40v päästä.Ei ole kyllä lomamatkoja tarvinnut jättää pois. Viime vuonna kävin Prahassa ja Budapestissä tänä vuonna olen jo käynyt Maltalla. Isommalle asunnolle ei ole tarvetta tai autolle, kun en ole perheellinen. Lähinnä sitä, että mielestäni pienistäkin tuloista voi säästää ilman, että tarvitsee erityisen paljon nuukailla tai muuten elää epämukavasti.

Se on ihan mitä kukakin arvostaa.

- Liittynyt

- 17.10.2016

- Viestejä

- 7 542

Aattele. Jos jättäisit sijoittamiset pois voisit ehkä asia saunallisessa kaksiossa, omistaa tai hommata auton ja vois ehkä jäädä rahaa lomamatkoihinkin. Eikä tarviis kesällä käydä töissä kun jätät sijoittamiset tekemättä. Moni opiskelee ilman kesätöitä ja ihan hyvin tulee toimeen.

Alkaa menemään jo OT:ksi mutta kolmannen asteen opiskelija saa niistä kesätöistä kyllä jotain paljon tärkeämpääkin kuin rahaa, nimittäin työkokemusta. Voi olla aika nihkeää valmistumisen jälkeen, jos ei ole tullut tehtyä töitä edes kesäisin ja ansioluettelo on tuolla saralla tyhjää täynnä. Noin muuten en kyllä ymmärrä tätä koko väännön ideaa. Jos ei ole halua/varaa sijoittaa niin ei tarvitse, mutta ei tarvitse sitten myöskään huudella niille joilla on halua tai varaa sijoittaa.

- Liittynyt

- 01.03.2019

- Viestejä

- 321

- Liittynyt

- 02.08.2018

- Viestejä

- 670

Niimpä. Ehkä joku arvostaa vähän erilaisia asioita. Joku ehkä haluaa asua väljemmin ja haluaa omistaa auton mielummin kuin sijoittaa muutama ropo osakkeisiin mistä pääsee mahdollisesti nauttimaan 40v päästä.

Se on ihan mitä kukakin arvostaa.

Prioriteettijuttuja, mutta eihän ne rahat sijoituksissa missään jäissä ole. Missä tahansa kohtaa ne voi realisoida ja käyttää.

Toi mitä toisella on ja toisella ei on ihan turhaa haihattelua. Jokaisella on omat juttunsa tärkäysjärjestyksessä jotka menevät sen säästämisen yli. Samoin kuin perutyöttömän haukkuminen kun se sanoo että ei ole varaa. Aina löytyy joku joka sanoo:

-"Ei ole muka rahaa ja silti on noin iso telkkari olohuoneessa"

-"Ei ole muka rahaa ja silti omistaa kotiteatterin"

-"Ei ole muka rahaa ja silti omistaa koiran"

-"Ei ole muka rahaa ja silti juovat alkoholia"

-"Ei ole muka rahaa ja silti asuvat kaksiossa vaikka yksiökin riittäisi"

-"Ei ole muka rahaa ja asuvat vuokralla vaikka oma olis järkevämpi"

-"Ei ole muka rahaa ja silti asuvat keskustassa missä on korkeammat asumiskulut"

-"Ei ole muka rahaa silti omistavat niin uuden auton"

-"Ei ole muka rahaa ja silti omistavat auton"

-"Ei ole muka rahaa ja silti käydään viikottain ravintolassa"

-"Ei ole rahaa ja silti on lapsia, ajattelisivat ensin"

Tää on ihan loputon suo. Jokaisella ihmisellä on ne prioriteetit elämässä ja kaikki eivät voi vaan laittaa 300e säästöön ja 300e uuteen puhelimeen. Jodenkin on pakko valita kumpaan rahansa käyttävät. Ja silloin kun tulot on pienet niin sitä monesti käyttää sen rahan johonkin mistä tulee hyvä mieli ja auttaa nauttimaan elämästä tässä ja nyt. Se ei välttämättä auta että sulla on 40v päästä tilillä enemmän rahaan kun ensin 60v syöt kaurapuuroa ja elät vuokrayksiössä.

Pointtini oli nimenomaan se, että ihmisillä on eri prioriteetit, mutta mielestäni on turhaa väittää, ettei ole rahaa sijoittaa samalla kun käy esim. Baareissa viikonloppuisin tai lottoaa joka viikko ja pelaa pelikonetta kauppreissun yhteydessä. Enkä minä ainakaan puhunut 300€/kk sijoituksista, vähempikin riittää. 15€ on minimi superrahastoissa. Nordealla saa 1% kuluilla vaikka yhden nokian osakkeen.

Joku tuossa jo kirjoittikin, ettei se säästämisen pointti ole välttämättä odotella sitä 40vuotta. Pienituloisella, jos tulee se 500€ pesukone, kännykkä hajoaa, vuokra pitäisi maksaa ja syödäkin, niin on aika helppo laittaa myyntitoimeksianto ja nostaa tarvittava summa.

Vähän kärkkäästi kirjoitin, eikä tarkoitukseni ollut haukkua perus työtöntä, vaan ihmetellä sitä, kuinka kyse ei niinkään ole siitä rahan puutteesta vaan eri prioriteeteista, tietämättömyydestä tai ihan vaan laiskuudesta.

Toi mitä toisella on ja toisella ei on ihan turhaa haihattelua. Jokaisella on omat juttunsa tärkäysjärjestyksessä jotka menevät sen säästämisen yli. Samoin kuin perutyöttömän haukkuminen kun se sanoo että ei ole varaa. Aina löytyy joku joka sanoo:

-"Ei ole muka rahaa ja silti on noin iso telkkari olohuoneessa"

-"Ei ole muka rahaa ja silti omistaa kotiteatterin"

-"Ei ole muka rahaa ja silti omistaa koiran"

-"Ei ole muka rahaa ja silti juovat alkoholia"

-"Ei ole muka rahaa ja silti asuvat kaksiossa vaikka yksiökin riittäisi"

-"Ei ole muka rahaa ja asuvat vuokralla vaikka oma olis järkevämpi"

-"Ei ole muka rahaa ja silti asuvat keskustassa missä on korkeammat asumiskulut"

-"Ei ole muka rahaa silti omistavat niin uuden auton"

-"Ei ole muka rahaa ja silti omistavat auton"

-"Ei ole muka rahaa ja silti käydään viikottain ravintolassa"

-"Ei ole rahaa ja silti on lapsia, ajattelisivat ensin"

Tää on ihan loputon suo. Jokaisella ihmisellä on ne prioriteetit elämässä ja kaikki eivät voi vaan laittaa 300e säästöön ja 300e uuteen puhelimeen. Jodenkin on pakko valita kumpaan rahansa käyttävät. Ja silloin kun tulot on pienet niin sitä monesti käyttää sen rahan johonkin mistä tulee hyvä mieli ja auttaa nauttimaan elämästä tässä ja nyt. Se ei välttämättä auta että sulla on 40v päästä tilillä enemmän rahaan kun ensin 60v syöt kaurapuuroa ja elät vuokrayksiössä.

Köyhä on ihminen, joka näkee nälkää, kärsii kylmästä tai ei saa juodakseen puhdasta vettä. Kaikilla muilla on varaa sijoittaa.

- Liittynyt

- 01.03.2019

- Viestejä

- 321

Köyhä on ihminen, joka näkee nälkää, kärsii kylmästä tai ei saa juodakseen puhdasta vettä. Kaikilla muilla on varaa sijoittaa.

Aika moni elää tilanteessa, että marketin makkarahyllyllä joutuu valkkaamaan sen halvimman lauantaileikkeen, että säästää kuukauden menoissa sen 7 euroa.

Ja ei ollut vitsi.

- Liittynyt

- 24.10.2016

- Viestejä

- 4 062

Sehän se vaan useimmilla noista "ei ole rahaa"-tyypeistä, että ne rahat yleensä hukkuu asioihin mistä ei hyödy eikä nauti. Ne on yleensä pieniä asioita, joiden kasaantuessa ne rahat katoaa ja käteen ei jää mitään. Jos tollanen tyyppi tienaisi enemmän niin sille ei jäisi yhtään enempää rahaa käteen vaan ne nekin rahat hupuloitaisiin. Sen takia näitä "ei oo varaa" tyyppejä näkee hyvinkin tienaavissa ihmisissä.Tää on ihan loputon suo. Jokaisella ihmisellä on ne prioriteetit elämässä ja kaikki eivät voi vaan laittaa 300e säästöön ja 300e uuteen puhelimeen. Jodenkin on pakko valita kumpaan rahansa käyttävät. Ja silloin kun tulot on pienet niin sitä monesti käyttää sen rahan johonkin mistä tulee hyvä mieli ja auttaa nauttimaan elämästä tässä ja nyt. Se ei välttämättä auta että sulla on 40v päästä tilillä enemmän rahaan kun ensin 60v syöt kaurapuuroa ja elät vuokrayksiössä.

Pienellä itsehillinnällä rahankäytössä sitä voisi oikeasti saada niitä asioita, joista nauttii ja tulee hyvä mieli, pienilläkin tuloilla...

Uutiset

-

Intel julkaisi uudet Xeon 6+ -prosessorit ja herätti samalla ulkopuolisen kiinnostuksen Intel 18A -prosessiin

6.3.2026 14:34

-

Google esitteli maaliskuun Pixel Dropissa uusia ominaisuuksia omille Pixel-puhelimilleen

6.3.2026 13:35

-

Live: io-techin Tekniikkapodcast (10/2026)

6.3.2026 09:00

-

Elgato julkaisi uuden Wave Next Audio -ekosysteemin

6.3.2026 02:58

-

Antec julkaisi järeän 900-kotelon tehokäyttöön

5.3.2026 19:49